In the high-paced world of startups, achieving success isn’t just about having a great idea—it’s about turning that idea into a scalable, sustainable business. This transformation requires founders to consistently track and measure key performance indicators (KPIs) that reflect their progress.

My POEM Framework, which stands for Proposition, Organization, Economics, and Milestones, offers a structured approach to measuring and driving startup growth. Understanding the metrics within each pillar can help founders navigate the critical stages of their fundraising journey.

This journey starts with the first set of customers buying the startups MVP (Minimum Viable Product) built from funding from the Founders, Family, Friends, Fans (and some say Fools) and continues as a funding journey followed by Angel, Venture Capital and other investors participating in Pre-Seed, Seed, Pre-Series A to Series A funding rounds.

I keep getting asked by founders and investors alike about how to turn great ideas into scalable startups. That’s why I’m excited to share the metrics based on the POEM framework designed to help founders build stronger companies, make data-driven decisions, and gain investor confidence.

Whether you’re navigating early growth stages or seeking funding, these metrics will guide you through the critical aspects of scaling, ensuring you’re well-prepared for the journey ahead. In this article, I’ll break down what truly matters when transforming ideas into successful, scalable ventures.

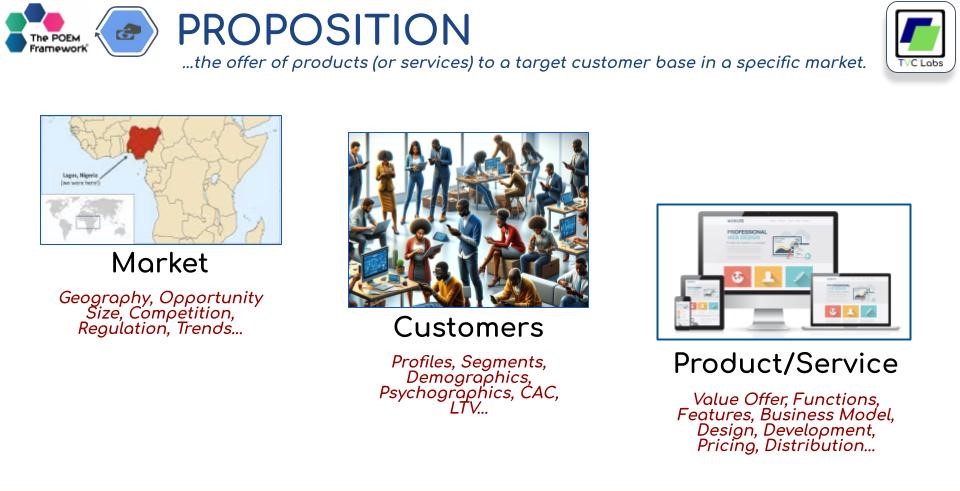

Proposition: Building a Solid Market Offer

The Proposition pillar is all about the product or service you’re offering and how well it fits the market’s needs. Startups need to measure how effectively they are solving a problem for their target customers.

Key Metrics:

- Product-Market Fit (PMF): This is the holy grail for any startup. Look for metrics that indicate customer satisfaction, such as a Net Promoter Score (NPS) or customer retention rates. A high NPS and growing customer base signal that people not only love your product but are recommending it to others.

- Customer Acquisition Cost (CAC): How much does it cost you to acquire a new customer? Keeping this number low, especially in the early stages, shows efficiency in marketing and sales.

- Customer Lifetime Value (CLV): The potential revenue from a customer over their lifetime. If CLV is significantly higher than CAC, it’s a strong indicator of product-market fit.

What Investors Want to See:

By Pre-Series A, investors will expect proof of PMF and a deep understanding of your market. At all stages you will need to demonstrate that you are acquiring customers at a sustainable cost and that those customers are staying with you.

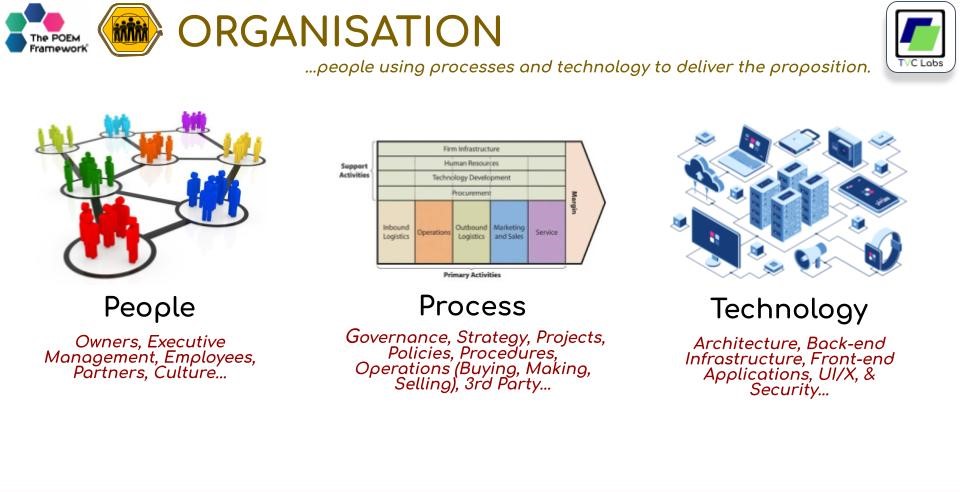

Organisation: Scaling Team and Ops

The Organization pillar focuses on the structure, people, and processes within your startup. Investors want to see how well your team is executing and scaling operations to support growth.

Key Metrics:

- Team Efficiency: How well is your team delivering on key goals? Look at metrics like employee productivity, burn rate per employee, and time-to-hire for key roles.

- Operational KPIs: These could be related to the product’s performance (e.g., uptime, customer service response times) or internal efficiency metrics (e.g., time-to-market for new features).

- Team Composition: Investors look for a balanced team with the right mix of skills—technical, operational, and leadership—able to execute and scale. Employee retention rates and hiring velocity are key indicators here.

What Investors Want to See:

At the Pre-Seed stage, lean operations are expected. But by Pre-Series A, investors want to see a robust organisational structure that’s ready to scale. Showcase your team’s ability to execute efficiently while controlling burn rate.

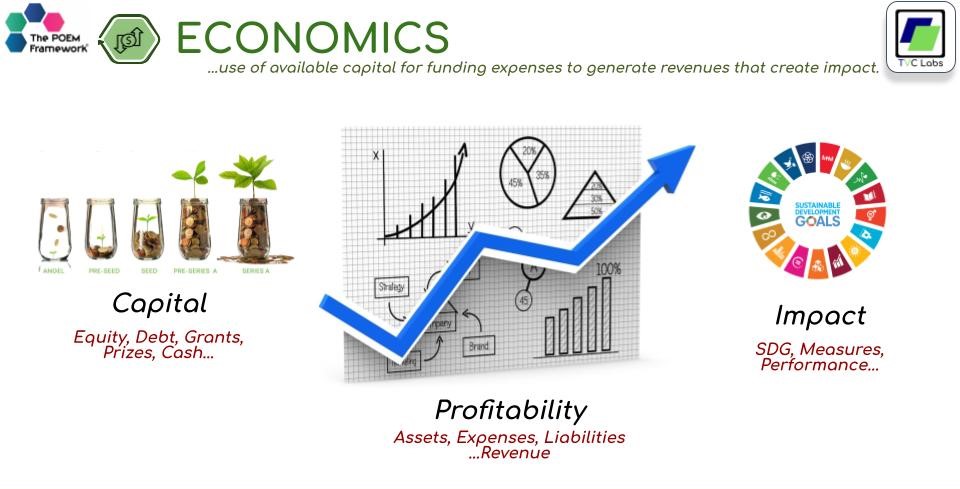

The Economics pillar is where your startup demonstrates financial sustainability. Investors need to see that your business can generate consistent revenue and scale profitably.

Key Metrics:

- Revenue Growth: Investors want to see consistent month-over-month or quarter-over-quarter revenue growth. By Seed stage, your Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) should be climbing steadily.

- Gross Margins: A solid understanding of your gross profit margins indicates whether your business can be profitable in the long run period!!

- Burn Rate and Runway: How fast are you spending cash, and how long will your current funds last? A startup with a healthy cash runway (at least 12–18 months post-fundraise) is more attractive to investors.

- Customer Churn Rate: This shows how many customers stop using your product. Keeping this low is crucial to proving a sustainable business model.

What Investors Want to See:

As your startup moves from Pre-Seed to Seed, investors will demand evidence that your revenue model works. They’ll want to see efficient capital allocation (low burn, high revenue growth) and a clear path to profitability.

Milestones: Your Growth Journey

The Milestones pillar is where you track and celebrate key achievements. These milestones serve as positive proof points that your business is progressing as planned.

Key Metrics:

- Customer Acquisition Milestones: Hitting targets like your first 100, 1,000, or 10,000 customers shows traction.

- Product Milestones: Completing your MVP, releasing new product features, and launching in new markets are critical moments that show growth.

- Funding Milestones: Successfully closing your Pre-Seed round, followed by Seed and Pre-Series A, demonstrates your ability to attract investment and manage capital effectively.

What Investors Want to See:

Investors look for a track record of hitting critical milestones. These milestones should reflect progress toward scalability and increased market presence. By Pre-Series A, founders should have clear growth metrics that demonstrate the potential to expand into new markets and enhance product offerings.

Using POEM to Attract Investors

By applying the POEM Framework, you can present a holistic picture of your startup’s journey to potential investors:

- Proposition: Show investors how your product fits the market and meets customer needs.

- Organisation: Demonstrate that you have the right team and operational processes in place to scale.

- Economics: Prove that your business model is financially sound and scalable.

- Milestones: Track progress and share evidence of hitting key growth targets.

In every fundraising round, these metrics act as benchmarks to measure your startup’s readiness and attractiveness to investors. By mastering these, you will not only boost your chances of securing funding but also ensure that your startup is on a solid path to success.

Conclusion

Whether you’re a founder trying to build the next unicorn or an angel investor mentoring a new entrepreneur, the POEM Framework provides a comprehensive toolkit for assessing a startup’s health and guiding its growth. By focusing on these key metrics throughout the fundraising journey—from Pre-Seed to Series A—startups can improve their chances of scaling effectively, while investors can make more informed decisions.

Let’s build ventures that not only attract funding but also create lasting impact!

You can find more details about the POEM Framework in my book “Investment Worthy Startup” which is available in Nigeria from RovingHeights (Naira) and worldwide through Amazon ($)